This makes it all the more reason for India to make electric cars and vehicles a priority in the fight against the reliance on fossil fuels.

While the initial push was seen towards making two-wheelers and three-wheelers electric, the bigger need is for electric public transportation and cars. Despite the existing challenges and ambiguity inherent in the sector, major auto manufacturers are now looking at this widely untapped sector with hope.

Since then the country has been willing to adopt a 360-degree approach in order to turn into an EV nation.

In December 2019, in the Climate Risk Index 2020 released by the environment think tank, Germanwatch, India’s rank has worsened from the 14th spot in 2017 to 5th in 2018 in the global vulnerability ladder. That puts into perspective the concerted efforts across the aisle for green mobility and electric cars. India’s focus on next-gen mobility has definitely taken on legs under the current government, but the ‘National Electric Mobility Mission Plan (NEMMP) 2020’ was actually unveiled in 2013 under the previous Congress-led government.

So What Is An Electric Car?

For the uninitiated, an electric car is just a car propelled by one or more electric motors using energy stored in rechargeable batteries, instead of burning petrol or diesel internally and exhausting fumes. Once this performance reality sets in, there will be no turning back from electric vehicles, added Moran.

Creating the closed-loop mobility ecosystem

Along with charging infrastructure, the establishment of a robust supply chain will also be needed for automakers to make the shift feasible at their end. That puts into perspective the concerted efforts across the aisle for green mobility and electric cars. This could be applied in a gradual way leading to 60% by 2025.

Access to vehicular loans for EVs to the end-user at interest rates at par with normal vehicles even for new brands.

“Subsidizing manufacturing for every aspect of an electric drivetrain will certainly improve the odds. A shift in the electricity generation landscape as a whole is what is required to facilitate the growth of electric cars. It is common to find users anxious about the speed and range of EVs. Once people see that the shift to 2 wheelers is not only silent and economic, this will create an impetus for the shift for cars. “We would like to believe that mass adoption will not take more than 5 years,” said Singhal.

Again, this is largely solved through scale since it becomes a game of more supply that accommodates for larger, more cost-effective batteries that provide a better overall range. At the moment, most manufacturers rely on batteries imported from Japan, China, Korea and Europe. But industry leaders are optimistic and believe that the shift will happen very soon owing to reasons such as the number of industry incumbents and startups making rapid and significant advancements in the EV segment, the growing demand and user interest and institutional interest. With the premium segment having access to both local and global electric car manufacturers, local manufacturers are required to build high-quality electric car models at par with global incumbents.

Will Electric Cars Gain Popularity In India?

In the last few years, trends suggest a rise in interest among the common masses for electric cars in comparison to electric two-wheelers and ICE or petrol/diesel cars, as seen on Google Trends.

Industry leaders consider electric cars to be a promising option for Indian audience for many reasons. Akhil Aryan, CEO and cofounder ION Energy believes that timely adoption coupled with the electrification of the existing vehicles and growth of charging infrastructure will create a shift, the impact of which will be felt in metropolitan cities especially given that pollution has reached catastrophic levels.

Further, Zoomcar founder Greg Moran added that with the median age of Indians being 27 years, the younger generation is driven for innovation, sustainability and environmental conservation. Over and above the robust operating cost angle, EVs also possess an inherent advantage when it comes to performance and driveability.

What Are The Challenges In Consumer Adoption Of Electric Cars?

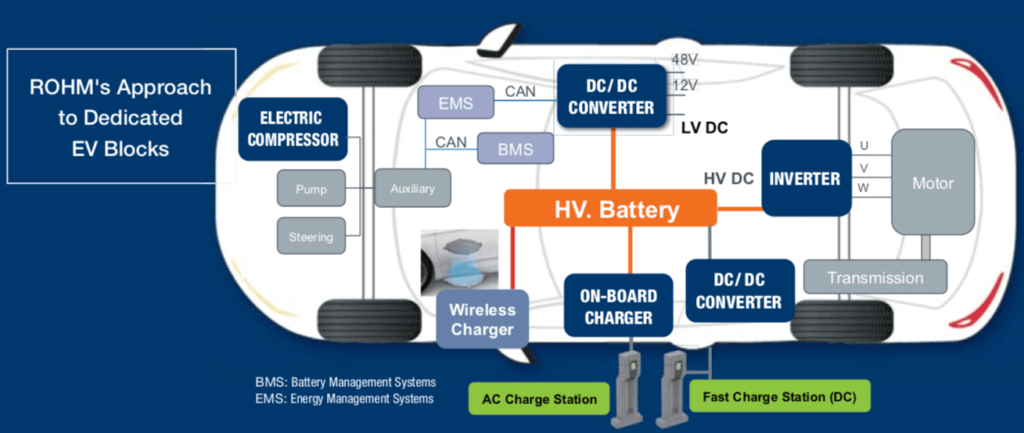

Breaking away the old norms and establishing a new consumer behaviour is always a challenge. There are broadly three kinds of electric cars at present:

1. Solar-powered electric cars and vehicles

2. Hybrid electric cars powered by a mix of internal combustion and batteries

3. Electric cars with on-board battery packs also known as battery electric vehicle (BEV)

More often than not, electric cars in the context of mobility and environmental conservation refer to battery electric vehicles, but may also refer to plug-in hybrid electric vehicles (PHEV)

In the Indian context, automobile manufacturers have announced electric four-wheelers such as Hyundai Kona Electric, Mahindra e-Verito, Mahindra e2o, Porsche Taycan, Tata Tigor EV 2019, MG ZS. At present, the Hyundai Kona electric has the highest range of 452 km on a single charge among electric cars available in India, which could change in the years to come.

Increasing Domestic Manufacturing

According to Clean Technica, India imported $1.23 Bn worth of lithium-ion batteries in 2018-19, six times higher than in 2014-15, highlights ION Energy’s Aryan. This directly impacts the purchasing power of consumers, even though new-age models of shared mobility help users offset a lot of this cost.

“As the demand picks up and manufacturers commission tech advancements to bring down the cost of manufacturing, EVs will achieve mainstream adoption.

With enthusiasm rising around the chances of Elon Musk’s Tesla launching in India in 2020, many local and global auto manufacturers have started testing the waters in the Indian market for electric cars.

Bridging the supply-demand gap

Another major challenge preventing larger-scale adoption of EVs today is the fact that the range is quite limited, thereby constraining the use-cases for electric vehicles. On average, electric vehicles are 75-80% cheaper from fuel and maintenance perspective, which is an important consideration for many consumers who have high usage. While only 1,500 electric cars were sold for personal use between April and December 2019, electric two-wheeler sales under FAME crashed by 94% in the first six months of FY20.

“79% of all vehicles sold in India during 2018 were scooters. This reality holds true across form factors because it’s materially cheaper to charge a battery compared to refuelling a conventional liquid fuel tank.

Moreover, EVs have 75-80% fewer moving components and this ultimately translates to a much lower maintenance bill. These imports were made from China, Taiwan and South Korea. Thus, a lot of sensitisation and education is needed, in order to bust several myths and promote EVs within the Indian market, Zoomcar’s Moran told Inc42.

Apart from this, there are a number of challenges in the adoption of electric vehicle cars in India in the near future. India’s focus on next-gen mobility has definitely taken on legs under the current government, but the ‘National Electric Mobility Mission Plan (NEMMP) 2020’ was actually unveiled in 2013 under the previous Congress-led government. Better researched go-to-market strategies by companies will ensure that they can manage their rollouts in an amplified manner,” explained Aryan.

How Auto Manufacturers Can Help Bridge Gaps?

There are 5 key areas that auto manufacturers are looking at when it comes to improving the state of the ecosystem. At the same time, by manufacturing vehicles, components and batteries together, various established conglomerates and startups are ensuring indigenous availability of products.

What Are The Advantages Of Electric Cars Over Fuel Cars?

At a fundamental level, electric cars offer a dramatically lower operating cost compared to conventional internal combustion engines. A combination of solar-powered grid solutions that are organized with a general improvement in grid resilience will ensure adequate charging infrastructure for EV’s being a green option,” he told us.

How Can The Government Promote Electric Cars Further?

The Indian government is gunning for its goal of making 30% of Indian vehicles electric by 2030. The steps taken in 2019 to promote electric vehicles in the country include:

1. Special policy measures such as slashing GST on EVs to 5% versus 28% for combustion engines

2. INR 1.5 lakh tax exemption on loans to buy electric vehicles

3. INR 10K Cr allocated to FAME II to push electric mobility through standardisation

4. Union cabinet has proposed customs duty exemption on certain EV parts including electric drive assembly, onboard charger, e-compressor and a charging gun to cut down costs

5. To localise the value chain, cabinet outlayed a five-year phased manufacturing programme (PMP) until 2024

6. Nearly a dozen states either issued or proposed electric vehicle policies till date, with Delhi being the latest one.

“We will soon be pushing for setting up of bigger factories for battery manufacturing. If cells are produced locally, the entire battery pack could also be produced in India.

Reduce The Total Cost Of Ownership

The government needs to introduce incentives separately for consumers to ease the purchase and increase awareness about existing tax benefits and easy financing options. Since then the country has been willing to adopt a 360-degree approach in order to turn into an EV nation.

In December 2019, in the Climate Risk Index 2020 released by the environment think tank, Germanwatch, India’s rank has worsened from the 14th spot in 2017 to 5th in 2018 in the global vulnerability ladder. 2 wheelers occupy also lesser space and are small financial commitments in the beginning than cars and hence the shift will start here as India is a price-sensitive market,” said Aryan.

With the market being so volatile and lacking a sustainable demand, it is imperative to assess the time period India will take in switching to electric cars. Further, as ION Energy’s Aryan explained with lithium-ion batteries accounting for up to ~45% of EVs and a large portion of grid-connected solar installations, companies need to assess and reduce the total cost of ownership by finding smarter methods of extending battery life.

This includes mobility companies such as Ola and Uber that are incorporating EVs into their fleet, automotive OEMs designing EVs, battery-pack makers, operators, and owners of energy storage systems, financiers and insurance providers of energy storage assets.

Leveraging Tech To Reduce Range Anxiety

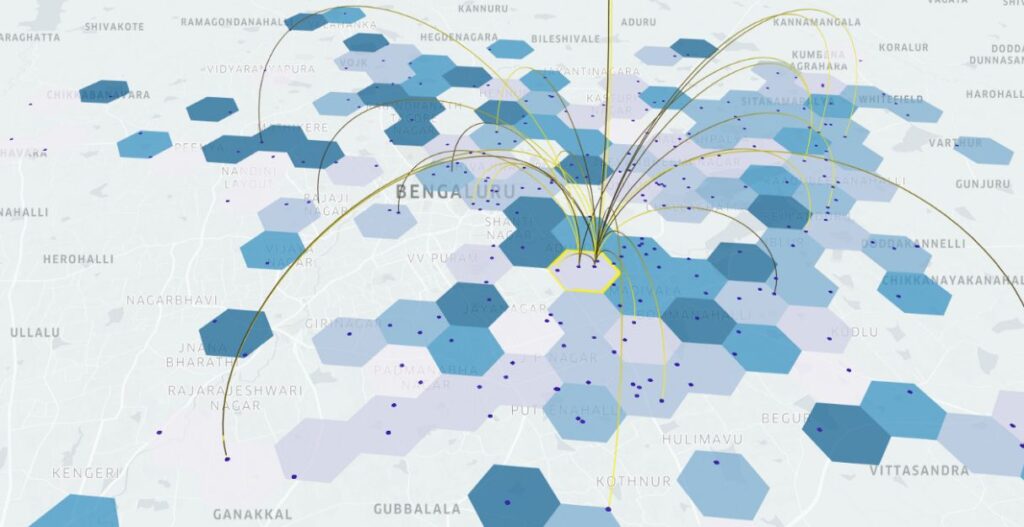

With various factors affecting range, performance and battery life such as chemistry, cell design, mechanical design, thermal management, traffic, terrain, weather, and more, there’s a need for intelligent tools and platforms that can leverage battery data, analytics, and machine learning algorithms to analyse and share accurate real-time updates and eliminate range anxiety.

Building charging infrastructure

The big challenge is of course charging infrastructure which will need to be combined with existing refuelling stations and at alternative locations closer to homes. But many more will be needed if India is to take meaningful steps towards becoming an EV-first nation. We are open to listening to new ideas and pushing them, so I encourage all founders to push the envelope,” Amitabh Kant, CEO, Niti Aayog, said recently.

Further, the industry leaders Inc42 spoke to highlighted more measures that are needed:

1. More incentives, tax cuts or rebates for every stakeholder in the mix, including the manufacturers and consumers

2. Facilitating access to capital both for R&D as well as manufacturing

3. Promotion of indigenous technology and capacity

4. Creating infrastructure supporting shared mobility

5. Offering a permit distribution for shared micromobility services as against a tendering system to open up the market

6. Promoting mobility-as-a-service using EVs

7. Phasing out ICE vehicles.

Setting up a cell manufacturing facility, even if the raw materials are imported, will help bring reduction in import value by up to 30% and reduce India’s dependence on other countries. This will reduce dependency on coal but India still buys a lot of coal. According to Aryan, improving battery swapping stations will eliminate wait time for charging, make better use of land, reduce the size of batteries in vehicles and will give an increased available range.

Further, the country’s charging infrastructure will need to be standardized. EV charging station vendors are perplexed at the moment, regarding the standard that should be adopted for fast charging. “Asking for 10GW additional capacity only for EVs is a huge ask,” he said.

ION Energy’s Aryan further emphasized about the need to increase adoption of solar power. Together these are expected to give a big boost to the ecosystem.

High Cost Of Manufacturing

This is definitely a key challenge that the manufacturers must address. Startups may further this cause by addressing the tech challenges and reducing the cost of manufacturing, either the complete vehicles or some of its key components, especially the battery,” Moran said.

Maintaining Quality Standards

The Indian consumer is on par with global consumers in terms of quality expectations and no longer accepts substandard products. “India is on track to become one of the largest solar and energy storage markets by 2025.

India’s focus on next-gen mobility has definitely taken on legs under the current government, but the ‘National Electric Mobility Mission Plan (NEMMP) 2020’ was actually unveiled in 2013 under the previous Congress-led government. That puts into perspective the concerted efforts across the aisle for green mobility and electric cars. Since then the country has been willing to adopt a 360-degree approach in order to turn into an EV nation.

In December 2019, in the Climate Risk Index 2020 released by the environment think tank, Germanwatch, India’s rank has worsened from the 14th spot in 2017 to 5th in 2018 in the global vulnerability ladder. This makes it all the more reason for India to make electric cars and vehicles a priority in the fight against the reliance on fossil fuels.

While the initial push was seen towards making two-wheelers and three-wheelers electric, the bigger need is for electric public transportation and cars. Despite the existing challenges and ambiguity inherent in the sector, major auto manufacturers are now looking at this widely untapped sector with hope.

Increasing battery performance

Given the fact that electric charging infrastructure will take considerable time to be replicated and the ubiquity of fuelling infrastructure in India, it is essential that batteries become far more durable to better compete with the internal combustion engine vehicles. At present, the Hyundai Kona electric has the highest range of 452 km on a single charge among electric cars available in India, which could change in the years to come.

How Long Will The Switch To Electric Cars Take?

According to media reports, currently EV market penetration is only 1% of the total vehicle sales in India, and of that, 95% of sales are electric two-wheelers. While only 1,500 electric cars were sold for personal use between April and December 2019, electric two-wheeler sales under FAME crashed by 94% in the first six months of FY20.

“79% of all vehicles sold in India during 2018 were scooters. Once people see that the shift to 2 wheelers is not only silent and economic, this will create an impetus for the shift for cars. 2 wheelers occupy also lesser space and are small financial commitments in the beginning than cars and hence the shift will start here as India is a price-sensitive market,” said Aryan.

With the market being so volatile and lacking a sustainable demand, it is imperative to assess the time period India will take in switching to electric cars. But industry leaders are optimistic and believe that the shift will happen very soon owing to reasons such as the number of industry incumbents and startups making rapid and significant advancements in the EV segment, the growing demand and user interest and institutional interest. “We would like to believe that mass adoption will not take more than 5 years,” said Singhal.

How Can The Government Promote Electric Cars Further?

The Indian government is gunning for its goal of making 30% of Indian vehicles electric by 2030. The steps taken in 2019 to promote electric vehicles in the country include:

1. Special policy measures such as slashing GST on EVs to 5% versus 28% for combustion engines

2. INR 1.5 lakh tax exemption on loans to buy electric vehicles

3. INR 10K Cr allocated to FAME II to push electric mobility through standardisation

4. Union cabinet has proposed customs duty exemption on certain EV parts including electric drive assembly, onboard charger, e-compressor and a charging gun to cut down costs

5. To localise the value chain, cabinet outlayed a five-year phased manufacturing programme (PMP) until 2024

6. Nearly a dozen states either issued or proposed electric vehicle policies till date, with Delhi being the latest one.

“We will soon be pushing for setting up of bigger factories for battery manufacturing. We are open to listening to new ideas and pushing them, so I encourage all founders to push the envelope,” Amitabh Kant, CEO, Niti Aayog, said recently.

Further, the industry leaders Inc42 spoke to highlighted more measures that are needed:

1. More incentives, tax cuts or rebates for every stakeholder in the mix, including the manufacturers and consumers

2. Facilitating access to capital both for R&D as well as manufacturing

3. Promotion of indigenous technology and capacity

4. Creating infrastructure supporting shared mobility

5. Offering a permit distribution for shared micromobility services as against a tendering system to open up the market

6. Promoting mobility-as-a-service using EVs

7. Phasing out ICE vehicles. For OEMs, 60% of new vehicles sold after April 1, 2025 should be zero-emission vehicles. This could be applied in a gradual way leading to 60% by 2025.

8. Access to vehicular loans for EVs to the end-user at interest rates at par with normal vehicles even for new brands.

“Subsidizing manufacturing for every aspect of an electric drivetrain will certainly improve the odds. Better researched go-to-market strategies by companies will ensure that they can manage their rollouts in an amplified manner,” explained Aryan.

Comments:

While India is operating in the same global context as other countries who have adopted an EV policy, it has a unique mobility pattern which other countries do not share.

While vehicle growth in India is rapid, ownership per 1000 population has increased from 53 in 2001 to 167 in 2015. India uses a large variety of motorized transport on roads and its auto-segments are quite different from that of most of the world.

Based on the last six years of sales data, the vehicles on Indian roads are estimated to consist of:

1. Two-wheelers: 79% of the total number of vehicles.

2.Three-wheelers (passenger and goods), including tempos: 4% of the total number of vehicles.

3. Buses and large goods vehicles like trucks: 3% of the total number of vehicles.

4. Economy four-wheelers (cars costing less than ₹ 10 Lac): 12% of the total number of vehicles.

5. Premium four-wheelers (cars costing higher than ₹ 10 Lac): 2% of the total number of vehicles.

The prevalence in India of small vehicles such as two-wheelers, three-wheelers, economy four-wheelers and small goods vehicles is unique among large countries.

These small vehicles require a unique set of technological and industrial capabilities. Here, India has an opportunity to take a leadership role in the electrification of small vehicles.

Alouk

alouk.srivastava@gmail.com

2021/05/18 at 2:38 pm